IDEAL FOR INTERNATIONAL VISITORS WHO DONT WANT TO DRIVE BY THEMSELVES IN USA

WHAT IS uDrive?

|

|

| GUESTS: | International Visitors / Tourists / Families |

| HOSTS: | Local Drivers with their own Cars |

| USE CASE: | One or multiple days trip to national parks, tourist spots, away from city |

PAIN

Millions of international travelers come to visit USA every year.

Many of them want to explore interesting places like tourist spots.

They either end up taking Tour packages or rely on friends or family,

BECAUSE THEY FEAR DRIVING BY THEMSELVES

REASONS: “LEFT HAND” VS “RIGHT HAND” SIDE DRIVING ON ROAD (Dangerous), UNKNOWN TRAFFIC RULES!

EARLY VALIDATION / PRE REVENUE TRACTION

Customers started signing up pre release

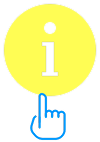

SOLUTION

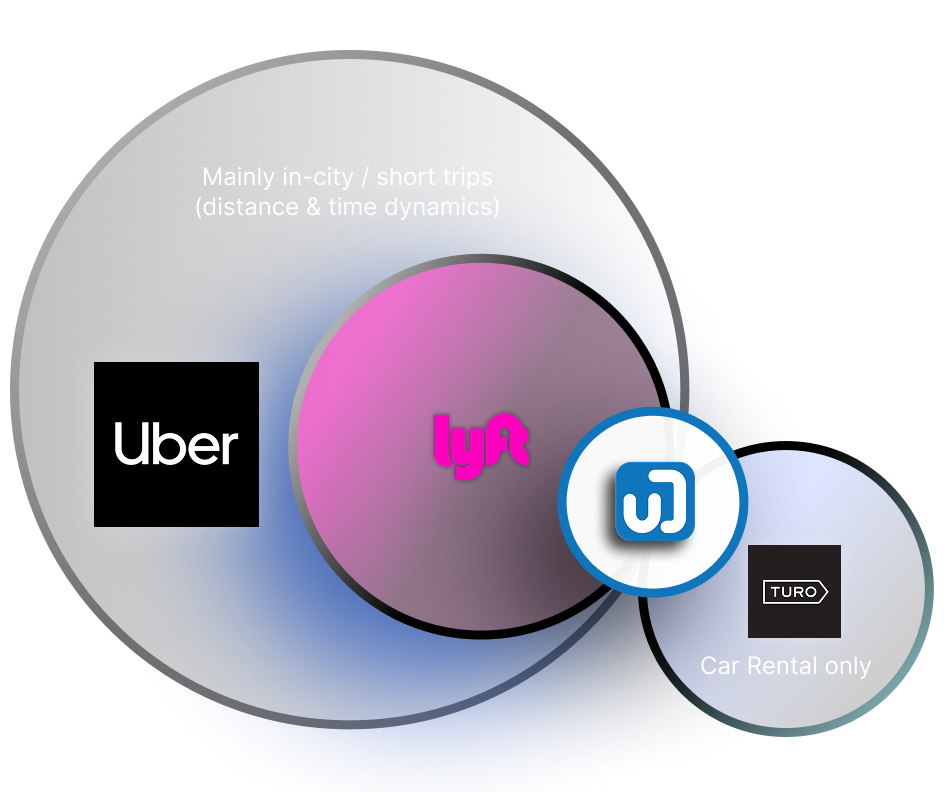

NOT JUST RIDE HAILING, NOT JUST CAR RENTAL

WE ARE BUILDING A NEW HYBRID CATEGORY OF

PERSONAL FREEDOM OF MOBILITY IN A FOREIGN COUNTRY

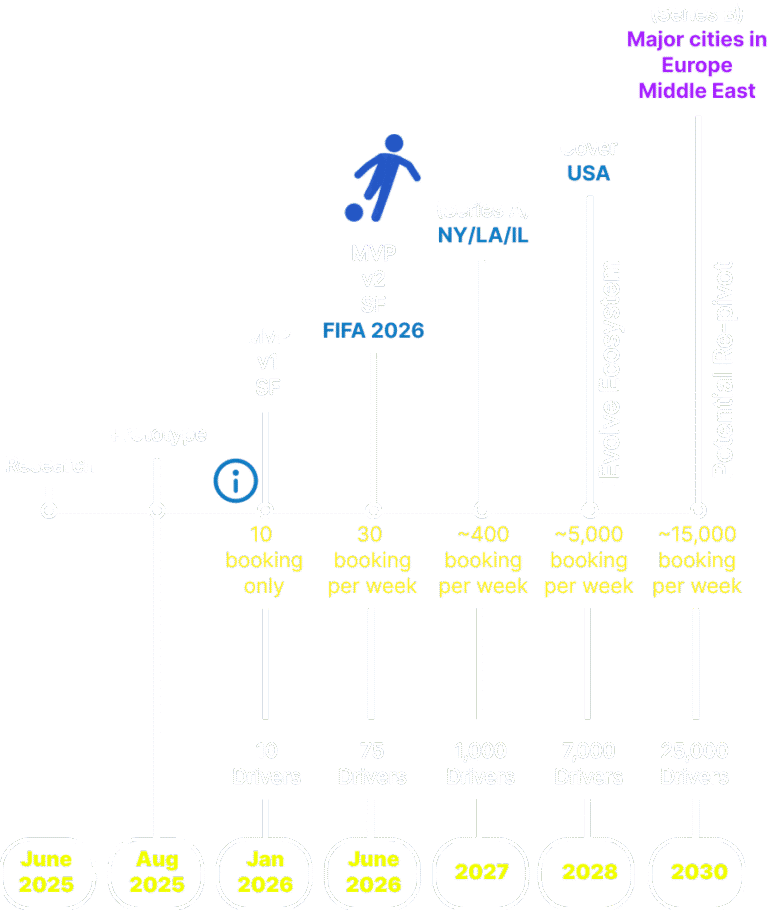

uDrive lets international Travelers (GUESTS) book vetted local Drivers with Cars (HOSTS) for multiple days private use with full freedom at a negotiated flat daily rate

TEAM

Bootstrapping on free runway

OUR TEAM MEMBERS ARE: Ex-Toyota Research, Ex-Uber, Ex-Microsoft, Synopsys and Google, Talents with 9 to 27 years industry experience.

We are automotive & mobility product researchers, engineers and developers. We all have interesting stories where we experienced and seen our families, relatives and friends face this problem repeatedly. We all devoted ourselves in this and are bootstrapping to build a platform that turns this common repeating problem into multiple opportunities.

Russell Kawsar

Founder

Expertise: Business dynamics and Product market fit. 2 Exits: (Pre and Post 2000). Contributed with R&D and innovative Products for: Toyota, Audi of Volkswagen, Boeing, Wyngate Aerospace, Nvidia, Niantic, Luma Ai (combined products market value est $ 2.7+ B)

Arunava Saha

Co-Founder

Expertise: Architect level Back End Engineer (20 years exp) 1 Exit and 10 Approved Patents. Contributed with product concepts to: Synopsys + Doxel founding member, helped grow from thousands to 100+ M for company. Series A and B and Exit

DEVOTED TALENTS ROLLED UP SLEEVES TO BOOTSTRAP

Christopher

Product Owner (Swell)

Shruti

UX Researcher (Uber)

Jennifer

Marketing Manager (Google)

Camilo

Full stack Eng (Uber)

Nigmat

Front End Dev (Apple/Uber)

Denis

Dev Ops Eng (Uber)

Waheed

Software Architect (Uber)

Harshini

Sr. Backend Eng (Ex-Uber)

Milena

Marketing CRM (UMW / Europe & Middle East)

WHY NOW

3 structural shifts have converged to make daily driver marketplaces viable for the first time

1. Platform Shift:

Marketplaces now support this model

- Trust & Tech Caught Up

- Identity verification & background checks are standard

- Mobile-first booking is normalized these days

- People are comfortable booking services using Apps (Airbnb, Turo)

- Payments, reviews, and insurance workflows are mature now

2. Demand Shift:

Tourist’s expectations grew

- Post-COVID preference for flexibility, privacy & freedom

- International Travelers started searching for better options

- Driving anxiety in the US remains high for international visitors

- Ride-hailing is expensive and unpredictable for full-day use

2. Supply Shift:

Driver’s behaviors changed

- Drivers started protesting, unhappy with non-transparency

- Driver’s expectation grew over time

- Driver’s needs shifted to push and secure a predictable income

- Driver’s started talking how much hourly they should earn

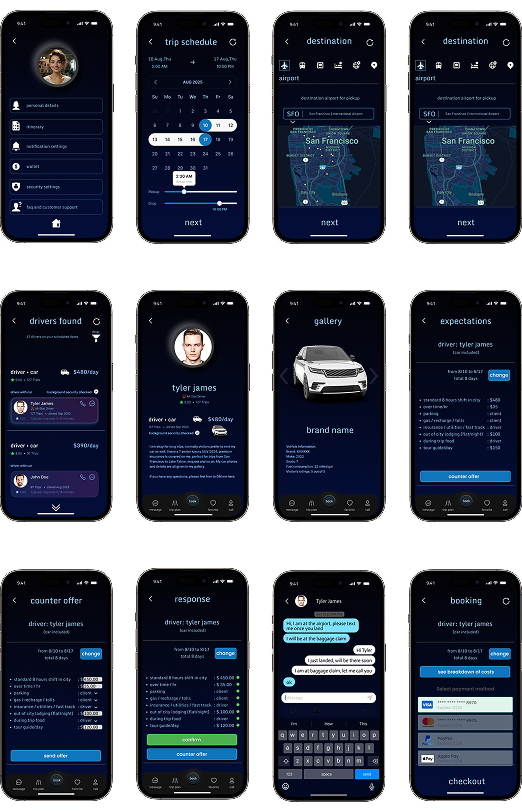

FIFA 2026

Golden timing for “Early Adoption”

JUNE 2026 Massive concentration of international visitors can validate demand fast

BUSINESS MODEL

Customer Segments

GUEST: International Visitors (77 M visited USA in 2024)

HOSTS: Drivers (Est 5.4 M in USA)

Channel

Mobile App / Web

Value Proposition

| For GUESTS: | Freedom, convenience and safety, 1 or multiple days flat rate |

| For DRIVER: | Multiple days earning model, Tour guide bonus income |

Revenue Streams

uDrive takes 22.5% Commission in each transaction

TAM SAM SOM

| TAM = < 100 B ^ (G) SAM = < 17 B ^ (G) SOM = < 1.15 B (USA) Tap Yellow Popup |

|

Un-tapped Blue Ocean

uDrive sits between car rental and ride-hailing, capturing trips that are underserved by both

| Uber: | 37 M Riders / week, 70 countries (15k cities) |

| Lyft: | 1.8 M Riders / week, US + Canada (658 cities) |

| Turo: | 470K Car booking / week, 5 countries (16K cities) |

GO TO MARKET STRATEGY

WIN users fast

Fast, low-cost roll out that proves demand and scales

FOCUSED PILOT

Start with 1 city 10 drivers (signed up)

CHANNEL MIX

Partnerships with Airlines, Hotels, Traveling agencies, Targeted Ads

NETWORK EFFECTS

Traveler referrals, Travel vloggers, FB community groups, Word of mouth (TRUST)

SCALABLE REPLICATION

Master on 1 city then roll into new Cities with same or slightly tweaked model (based on geo locations)

EARLY INVESTMENT

Early Entry = Highest Leverage

EXIT STRATEGY

Exits may follow. our long term aim is to evolve into a global brand through gaining TRUST

2032 GMV goal: $1.8 B ($400+ M revenue)

2035 GMV goal: $2.5 B ($720+ M revenue)

Exit options: Strategic acquisition, Secondary sale, or IPO (post-2033)

RUNWAY TOWARD QRR $1.2 M

Raising $ 910K

Launching early in 2026

By mid of 2027 this fund helps us achieve upto:

-/+ 400 bookings per week and 1,000 drivers

USE OF FUND

48% Partially compensate bootstrappers

9% Product Tech Development overalls

15% Compliance

12% Mass awareness, Campaigns, Ads

5% Operations and administrative

4% Legal

7% Contingency

LET’S TALK

We are eagerly waiting to hear from you

Please ask us at least one question

Say hello contact@udriveus.com

Copyright © 2025 All rights reserved